- July 12, 2023 -

By Lisa Murray-Roselli

Gold is the quintessential symbol of wealth and status. Throughout history, displaying, adorning oneself with, spending, and stockpiling gold have been the ultimate expressions of power. Gold bathrooms? A matter of taste. Proponents of the gold standard rely on the historic stability of this metal as the rationale for its use as the foundation for our monetary system. However, those in favor of fiat currency believe geopolitical and global economic conditions are inhospitable to this inflexible standard.

The gold standard is a monetary system in which the value of the US dollar was directly linked to the fixed value of an ounce of gold. England had established an official gold standard in 1821, owing to its enormous stockpiling of gold—the result of a significant increase in global trade and production. Major European nations joined England to create an international gold standard in 1871. By 1879, the United States had thrown its hat in the ring and this powerful coalition operated smoothly until 1914, when WWI disrupted political alliances, drove up international debt, and governments’ finances deteriorated.

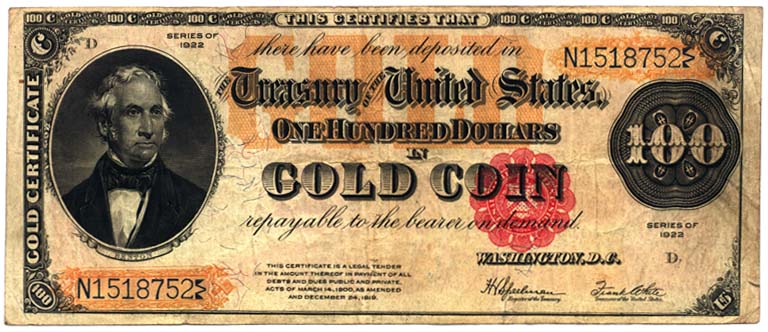

Gold certificates used as paper currency in the US (1882 to 1933)

Confidence in the stability of the gold standard continued to erode as economic conditions worsened: the stock market crash of 1929 brought the US economy to a screeching halt, war debts and reparations hobbled Germany’s economy, commodity prices collapsed, banks were overextended, and the rise in interest rates combined to weaken the whole of the global economy. By 1931, England had dropped out of the gold standard, which meant that the US and France held the largest gold reserves, but this move marked the beginning of the end for an international gold standard.

In 1934, the US revalued gold from $20.67 per ounce to $35 per ounce. The result was an increase in the conversion of gold to US dollars, which devalued the dollar but allowed the US to dominate the gold market. In July 1944, as WWII came to a close, delegates from forty-four nations met in Bretton Woods, New Hampshire to discuss the adoption of a new global monetary system. This new system pegged the value of all national currencies to the value of the US dollar, which converted to gold at the fixed rate of $35 per ounce.

After less than three decades, however, this system fell to the pressures of economic instability and geopolitical unrest. In 1971, volatility in the European markets caused countries such as Switzerland and France to convert their US dollars into over $1 billion worth of US gold reserves. After the British Ambassador asked the US Treasury to convert $3 billion into gold, President Nixon and his advisers knew it was time to end the connection between the US dollar and gold, before the country’s reserves were fully depleted. This decoupling became official in 1976, and the world has operated on a fiat system ever since.

The Latin word “fieri” means “an arbitrary act or decree” and is the root of the word “fiat.” Currency in a fiat monetary system is essentially without value because it is not backed by a physical commodity. Therefore, its value must be established through consensus and by government decree. It is influenced by a country’s economic and political stability, investment potential, and current economic performance. External factors such as geopolitics, pandemics, and global inflation also affect the value of currency.

The fiat system in the United States was the catalyst for institutions such as the Federal Reserve, which works to prevent inflation and stabilize the economy through volatile times. Rather than tying the country’s currency to a fixed-rate commodity, the fiat system allows governments more control over its value, enabling them to respond more immediately to domestic, geopolitical, and global economic influences. That flexibility also allows economies to grow quickly when the opportunity presents itself. Those who believe we would be better off going back to the gold standard site this flexibility as an essential flaw, rather than an asset, and it informs the basis of their argument.

Stability is a common theme amongst proponents of the gold standard—as long as there is a reliable supply of gold on the global market, currency values would remain stable. Additionally, government spending would be limited to the amount of gold in reserve, preventing hyperinflation, stabilizing global trade fluctuations (exchange rates would be fixed), and reducing the trade deficit by limiting the ability to seek foreign funding, thereby reducing spending. Some have even suggested that this limitation to spending would force the US to curtail military and defense spending, preventing needless wars.

Stability is a common theme amongst proponents of the gold standard—as long as there is a reliable supply of gold on the global market, currency values would remain stable. Additionally, government spending would be limited to the amount of gold in reserve, preventing hyperinflation, stabilizing global trade fluctuations (exchange rates would be fixed), and reducing the trade deficit by limiting the ability to seek foreign funding, thereby reducing spending. Some have even suggested that this limitation to spending would force the US to curtail military and defense spending, preventing needless wars.

Gold standard advocates maintain that the government’s ability to print money at will is a fundamental detriment to our economy and the reason our national debt is in the trillions of dollars. They firmly believe in the gold standard’s ability to reduce the risk of economic crises and recessions, which would, in turn, reduce the need to flood the economy with money in stressful times. Advocates also point to the self-regulating nature of gold—production is necessarily consistent with demand because gold is a finite resource. Therefore, the gold standard is an automated system that is not subject to hyperinflation or deflation. Proponents of the fiat system do not have this same confidence.

The main argument against the gold standard is its inflexibility, both to respond to crises and to opportunities for growth. Comparing recession/depression recovery times from the gold standard era to the fiat currency era brings this point into sharp focus. Under the gold standard, the 1882 Recession lasted 38 months and the Great Depression lasted 65 months. Contrast those with the Recession of 2007-2008, which lasted just 18 months because of interventions by the Federal Reserve and government regulators. That same responsiveness enables fiat currency to bolster economic growth and activity because the government can easily increase the monetary supplies needed to stimulate that growth.

The main argument against the gold standard is its inflexibility, both to respond to crises and to opportunities for growth. Comparing recession/depression recovery times from the gold standard era to the fiat currency era brings this point into sharp focus. Under the gold standard, the 1882 Recession lasted 38 months and the Great Depression lasted 65 months. Contrast those with the Recession of 2007-2008, which lasted just 18 months because of interventions by the Federal Reserve and government regulators. That same responsiveness enables fiat currency to bolster economic growth and activity because the government can easily increase the monetary supplies needed to stimulate that growth.

Additionally, economic growth outpaces the supply of gold: economic growth increases at a rate of 6.5% per year while the global gold supply only increases at a rate of 2% per year, so a gold-standard economy would be forced to grow more slowly. Gold is also a finite resource—inevitably, demand would overtake supply. Currently, with only 244,000 metric tons of gold discovered and available, the US would have to hold all of it in order to back its current economy and would be the sole major economy using the gold standard in which one US dollar would be worth only 1/237th of an ounce of gold.

Super Pit gold mine at Kalgoorlie in Western Australia [Photo Credit]

The gold standard flourished during a period in history that was relatively peaceful. Major world powers were in alignment economically and trading was robust. However, the disruption caused by WWI and its aftermath put an intolerable strain on the system. A key point to keep in mind is that a stable currency doesn’t guarantee a stable economy. It seems clear that, although gold remains a good investment and will probably always retain its value in the global economy, it cannot bear the weight and complexity of a world that is inconstant and requires greater agility or less political discipline from its monetary systems.

Order by 4:00

and it’s out the door.

1 oz. Gold or 100 oz. Silver

Trade Scrap for Bullion.

No-worry Shipments

Get paid fast!

(for qualified customers)

We don't make promises we can’t deliver on.