- July 11, 2022 -

By Lisa Murray-Roselli

Gold has always held intrinsic value and, since ancient times, has been revered for its beauty, association with the divine, and as a representation of wealth and status. Gold coins were among the first currency in ancient times. Because gold’s value is universally accepted, its use as currency eventually became standardized. In 1816, Britain officially adopted a gold standard. Then in the 1870s, gold became the the international standard for valuing currency.

The Gold Standard Act of 1900 solidified the commitment of the United States to this gold standard—gold would be the only metal redeemable for paper currency. This meant that the government would redeem paper money for its value in gold and that paper currency had a guaranteed value tied to an internationally-recognized and prized commodity. However, between 1900 and 1932, the US was confronted with several economic challenges as well as the struggles brought on by World War I. In an attempt to alleviate some of these challenges, the Gold Reserve Act of 1934 banned private ownership of gold unless officially licensed to do so. This effectively removed gold from circulation and meant that the US dollar was no longer pegged to its value.

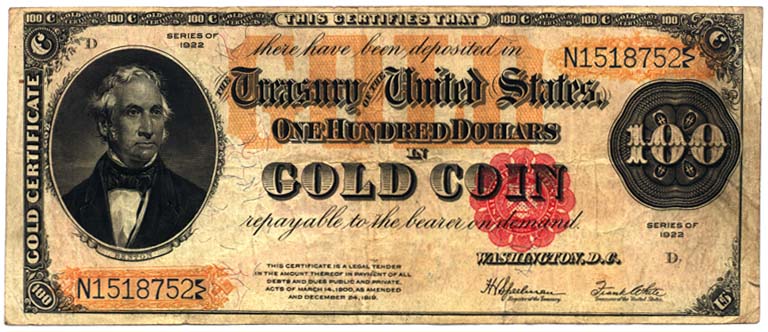

US Gold certificate that could be converted into gold coins.

Ten years later, the Bretton Woods Agreement and System, established by 730 delegates from 44 countries at the United Nations Monetary and Financial Conference in Bretton Woods, New Hampshire, established the US dollar as the official global currency. The US dollar would be pegged to the value of gold and all other currencies would be pegged to the US dollar. This had a stabilizing effect on international currency exchange rate volatility, which facilitated international trade relations.

Bretton Woods held until the late 1960s/early 1970s, when the US experienced an extraordinary strain on its political and economic systems. The Vietnam War, rising inflation, and the oil crisis were politically destabilizing and financially costly, causing foreign governments to lose confidence in the US dollar and a subsequent surge in the demand for gold. At the time, foreign governments possessed three times as many dollars as the US was able to redeem in gold, so, in 1971, President Nixon declared that the US would no longer convert dollars into gold at the official exchange rate. This move, called “The Nixon Shock,” protected the US reserves of gold from being depleted and was the beginning of the end of the Bretton Woods Agreement.

In 1973, the US dollar officially became a fiat currency and the gold standard was abandoned. Six European nations tied their currencies together and jointly floated against the US dollar—the origin of our current floating exchange rate system. The US dollar is no longer tied to any commodity and the price of gold is determined by demand.

Despite their official decoupling, gold and the US dollar are still entwined in an often inverse relationship. Experts say this is a largely psychological, rather than economic, dynamic. To start with, gold is usually valued in US dollars and as the value of the dollar rises and falls, there is an effect on gold prices. When the value of the dollar decreases, investors tend to fund commodities, including gold. This demand for gold drives up its value, resulting in that inverse relationship.

Conversely, when the value of the dollar rises, the cost of gold also rises, causing a decrease in the demand for gold, and therefore, its value. When the cost of a commodity rises, there are typically fewer buyers and demand declines. This is especially true when foreign currencies are not on par with the US dollar.

Although this inverse relationship is the norm, there are times when the cost of the US dollar and gold increase concurrently. This usually happens during times of crises in other countries, when investors are attracted to safer assets. Both the dollar and gold have proven to be reliable investments over time.

It is obvious that the mighty US dollar is a sound investment as it continues to retain its power in the global economy, but what about gold? What is it about this metal that gives it such power? Its supply is limited and it is difficult to extract, yet gold is ranked among the top ten most traded commodities. While it is valued by such industries as technology/electronics, jewelry, and dentistry, it is not nearly as critical to global industry as crude oil, steel, iron, copper, or aluminum, but holds firm to its position amongst them.

It is obvious that the mighty US dollar is a sound investment as it continues to retain its power in the global economy, but what about gold? What is it about this metal that gives it such power? Its supply is limited and it is difficult to extract, yet gold is ranked among the top ten most traded commodities. While it is valued by such industries as technology/electronics, jewelry, and dentistry, it is not nearly as critical to global industry as crude oil, steel, iron, copper, or aluminum, but holds firm to its position amongst them.

The answer, therefore, lies elsewhere. What gives gold its power and value? Human nature. Since its discovery, we have been attracted to it and have valued it as much for the intangibles we associate with it—status, glory, excellence, and the divine—as for its usefulness. Gold is the complete package: a useful, rare commodity and a brilliant precious metal that enhances our surroundings. These unique qualities allow it to maintain a symbiotic relationship with the US dollar.

Order by 4:00

and it’s out the door.

1 oz. Gold or 100 oz. Silver

Trade Scrap for Bullion.

No-worry Shipments

Get paid fast!

(for qualified customers)

We don't make promises we can’t deliver on.