- August 08, 2016 -

There are many drivers of precious metal prices, such as global economic growth, supply and demand, inflation expectations, interest rates, geopolitical turmoil, etc. However, one of the primary influences on the price of gold and silver, that investors must always keep their eye on, are movements in the global currency market and especially the U.S. Dollar.

The U.S. Dollar is the base currency for both gold and silver. This means in the global commodity markets gold and silver are generally bought using U.S. Dollars. Therefore, if the dollar weakens, gold and silver become cheaper to purchase and metal prices generally increase. Whereas if the U.S. Dollar strengthens it becomes more expensive for investors to buy gold and silver and on average precious metal prices will drop.

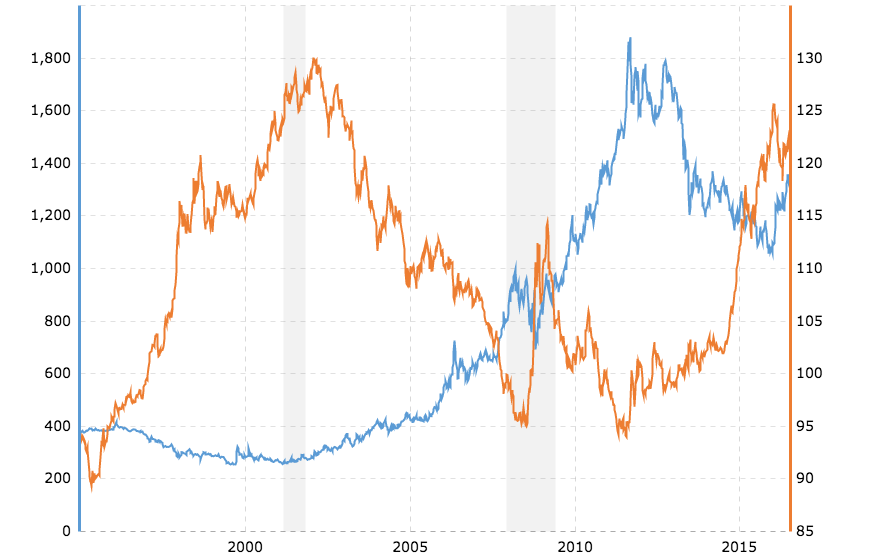

As the value of the dollar increases, the price of gold decreases, and vice versa. [Macrotrends]

Movements in the U.S. Dollar tend to have a strong negative correlation with the price of gold; the gold price can also affect movements in other currencies, especially those in emerging markets. During times when a countries domestic currencies are weakening dramatically, central banks tend to buy gold to compensate for that loss in value. This was witnessed recently when the currencies of Malaysia, Indonesia, and Thailand all saw a dramatic drop in their value in relation to the U.S. Dollar. As a result their central banks as well as many emerging market investors subsequently began buying physical gold as a safe haven investment and hedge against their local currencies.

Gold became an increasingly attractive option to emerging market central banks and individuals as well due to its strong performance in 2016 to date. Furthermore, countries suffering with high inflation tend to buy gold as an inflation hedge. Since gold is liquid and frequently traded it is often viewed as an alternative currency. For developing countries with volatile currencies gold has become a popular investment with central banks, especially in times of U.S. Dollar weakness.

Order by 4:00

and it’s out the door.

1 oz. Gold or 100 oz. Silver

Trade Scrap for Bullion.

No-worry Shipments

Get paid fast!

(for qualified customers)

We don't make promises we can’t deliver on.