- February 16, 2018 -

The cryptocurrency phenomenon continues with its mind-boggling volatility and millions of dollars gained and lost on a minute by minute basis.

Despite recent setbacks, Bitcoin and other cryptocurrencies have enjoyed significant appreciation since their initial offerings. But is this sudden rise a true indication of crypto’s value?

Although with luck you may pick a “crypto winner,” I believe gold is a far more useful asset than cryptocurrency.

Here are a few reasons why:

1) A vast majority of cryptocurrencies will fail.

The current rise in cryptocurrencies can be compared to the stock market’s dot.com bubble that burst in the year 2000.

A few internet companies like Amazon and Google survived; the rest failed. It is probable the same is true of cryptocurrencies.

Assuming governments don’t eventually create their own digital currencies, only a few, if any, current crypto offerings have a chance to survive and be profitable.

2) Cryptocurrencies have a lack of security.

Security is a major issue facing the cryptocurrency industry.

There are all too frequent major hacks involving a crypto exchange. With security issues surrounding cryptocurrencies not fully resolved, their ability to compete with gold or traditional investments is limited.

3) Speculation and hype are driving the value of cryptocurrencies.

Since the beginning of 2017 cryptocurrency values have skyrocketed. But this irrational spike in crypto prices suggests this is no more than a bubble.

Most individuals buy them for the sole reason of selling them in the future at a profit. This is pure speculation, not hedging.

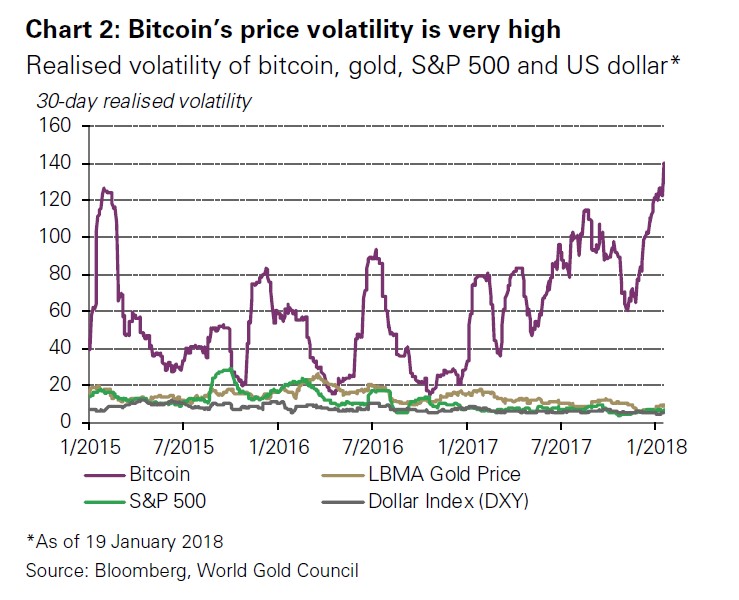

Compared to gold, the price of cryptocurrencies is much more volatile, making them a shaky financial hedge. [Chart: Valuewalk]

4) Cryptocurrencies are surprisingly similar to fiat money.

The definition of fiat money is a currency that is legal tender but not backed by a tangible commodity.

This has been the case with all major currencies, including the U.S. Dollar, since the United States abandoned the gold standard in 1971.

It’s clear that cryptocurrencies partially fit the definition of fiat money. They may not be legal tender yet, but they’re also not backed by any sort of physical commodity.

Logic suggests that you can’t hedge against a fiat currency with another form of fiat currency.

5) Gold is liquid; cryptocurrencies are not.

Gold is one of the most liquid assets available. It is easily converted to cash and its value is not restricted by national borders.

The same cannot be said about cryptocurrencies. It’s ironic–as speculation in cryptocurrenices skyrockets, so have the fees to transact in them or convert out of them.

For example, according to BitInfoCharts.com, Bitcoin’s transaction fees have vacillated wildly from a low of $0.68 per transaction this time last year to $55.00 per transaction in late December.

Currently, the rate is $5.00. The fee is fixed no matter how much you spend.

Obviously, these rates are not conclusive to retail transactions. As a result, retailers who were accepting Bitcoin are now backing away from it.

Liquid, Bitcoin is not.

6) Cryptocurrencies do not have gold’s history as a store of value.

While cryptocurrencies have been around for less than a decade, gold has been a store of value for thousands of years.

Over time we’ve seen that stocks and bonds have a minimal or negative correlation with gold, particularly during recessions, making gold a sound hedge against inflation, recession and fiat currencies.

In 2017 a rising stock market went hand in hand with rising cryptocurrency prices. In recent days, sharp drops in the stock market and crypto market were nearly simultaneous.

All this suggests a lack of hedging value in the cryptocurrency market.

The purpose of this article has not necessarily been to criticize cryptocurrencies.

We suspect that a limited number will do very well over time as the technology they represent has a bright future.

This article is simply meant to dispel the notion that cryptocurrencies can somehow replace gold in a 21st century portfolio. The simple answer is they can’t.

Order by 4:00

and it’s out the door.

1 oz. Gold or 100 oz. Silver

Trade Scrap for Bullion.

No-worry Shipments

Get paid fast!

(for qualified customers)

We don't make promises we can’t deliver on.