- November 15, 2017 -

Hundreds of years ago, early economists were puzzled by a quirk in pricing: why do some non-essential goods cost so much while truly essential goods cost so little? As an example, why are water and grain so cheap when they are so vital for human survival? Why are gold and diamonds so expensive when neither is a necessity?

The answer is quite simple. All economic based commodities are scarce to some degree. All things being equal, more scarcity = more value. There is a lot of water in the world, but not much gold. Both have significant value but for different reasons. Simply stated, it’s easier for most people to access fresh water than to mine an ounce of gold.

Gold is valuable for many reasons, but its relative rarity is one of the most important. In fact, gold is so scarce we might be running out. The notion that the world may be running out of mineable gold recently appeared in a Wall Street Journal article discussing the failed Barrick-Newmont gold mining merger. The author begins the article by stating: “The big dilemma for gold miners; there ain’t much gold left.” He’s correct. The lack of readily mineable gold is making life tough on mining companies worldwide. My only issue with the aforementioned article is that the author doesn’t seem to note the significance of running out of the world’s most famous precious metal.

The article goes on to say that, at current mining levels, we are only 20 years away from completely exhausting all of the discovered gold mines in the world. All of them. That isn’t to say that more gold can’t be found; it just isn’t common to find new pockets of the yellow metal. This has become more and more evident since the boom in global demand for gold over the last 25 years.

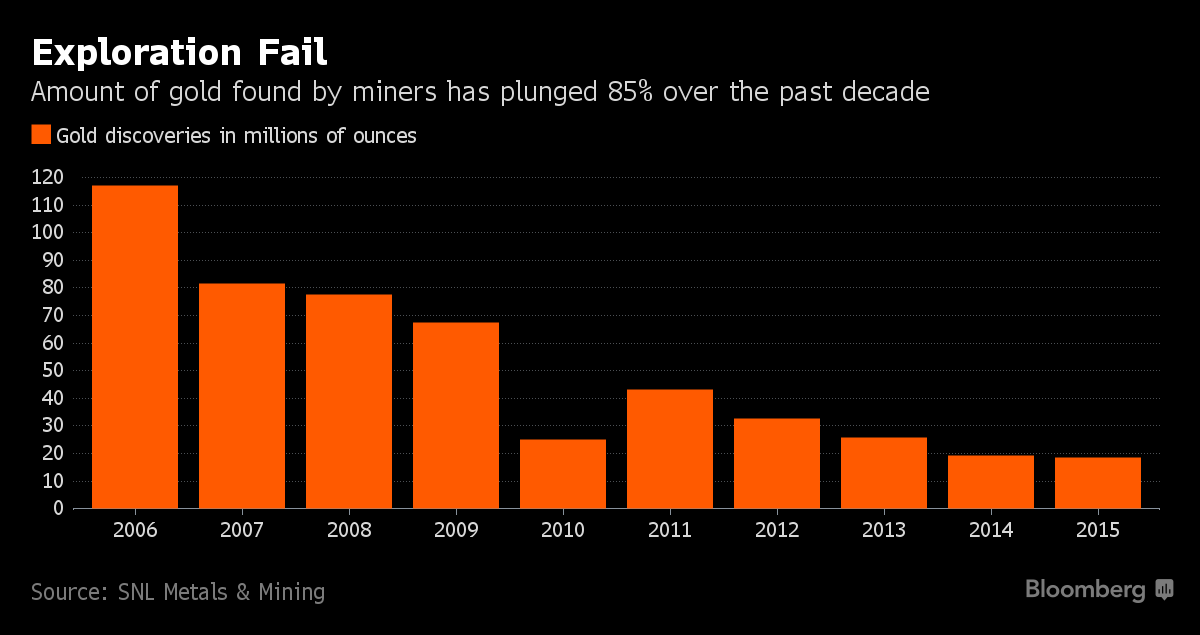

As the global demand for gold has increased, gold discoveries have decreased dramatically over the past decade, putting us at risk of running out of mineable gold within the next 20 years. [Image: GoldCore]

While there are estimates that there could be substantial quantities of gold beneath the Arctic Circles, the cost would be extremely prohibitive with gold at or near current levels. There also may be large pockets of molten gold near the earth’s core. However, it’s a safe bet we won’t be mining that anytime soon. Data suggests that gold production seems to have peaked around the year 2000 and has averaged an annual decline of approximately one million ounces since. Many speculate the next great gold deposit will likely to come from mining an asteroid! A topic for a future blog.

Gold has always been a good long-term store of value, but in the long run it may prove to be a better one. The demand for gold was at an all-time high from 2008-2013 and the current trend of decreasing supply could increase its value in the medium to long term.

Remember, gold’s relative scarcity contributes to its value. It’s Economics 101: the more demand for a commodity, the more valuable it will be; the less supply of a commodity, the more valuable it will be. Gold could have both of those factors going for it in the medium to long term.

Order by 4:00

and it’s out the door.

1 oz. Gold or 100 oz. Silver

Trade Scrap for Bullion.

No-worry Shipments

Get paid fast!

(for qualified customers)

We don't make promises we can’t deliver on.